By Fran García

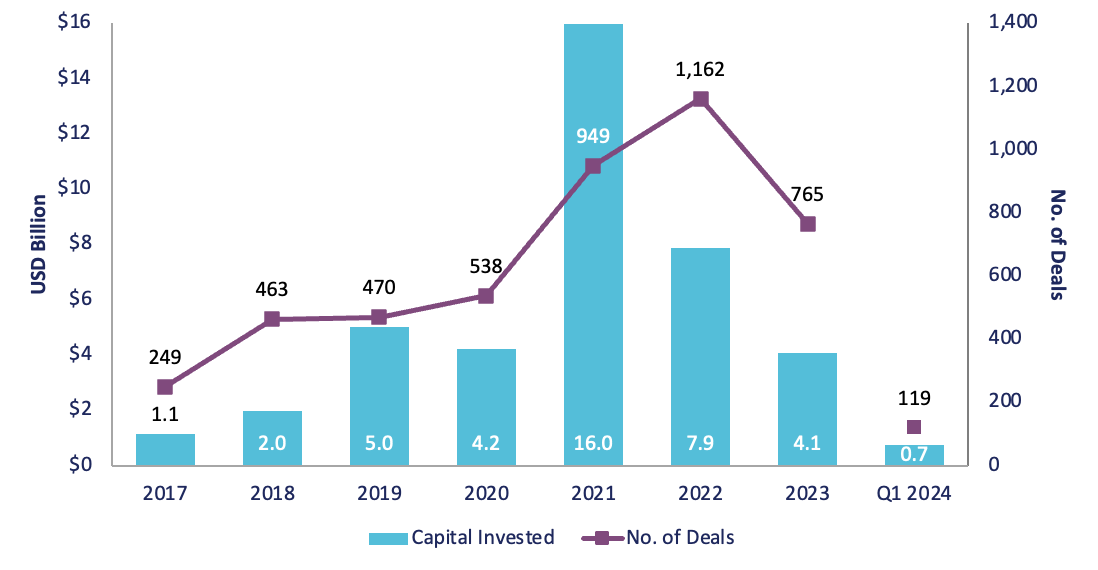

Private markets in Latin America have seen a transformative journey from 2017 through the first quarter of 2024. During this period, the region witnessed substantial growth in investments across various sectors, including venture capital (VC), private equity (PE), private credit, and infrastructure. The most significant surge occurred around 2021, propelled by a favorable economic environment and heightened investor interest. Despite a subsequent decline, private markets investments are stabilizing.

Annual Investment in Latin America, 2017-Q1 2024

Investment totals include VC, PE, private credit, and infrastructure & natural resources.

Exits and Market Liquidity: Annual exits in the region also followed a similar trajectory, with significant activity in 2021. The market has since faced liquidity challenges, influenced by stringent IPO standards, higher interest rates and the declining role of SPACs. These factors have created a challenging environment for companies looking to go public or secure major mergers and acquisitions. Despite these hurdles, the resilience of high-quality companies has been notable.

Annual Exits in Latin America, 2017-Q1 2024

Venture Capital Dynamics: In 2023, venture capital investments in Latin America closely mirrored the levels seen in 2020. The overall investment volume returned to a baseline similar to the pre-peak period, reflecting a stabilization following the extraordinary growth phase observed in 2021.

Annual VC Investment in Latin America, 2017-Q1 2024

Fundraising Activities: Although VC fundraising has been lower from the 2022 peak, managers still raised USD 40 million across four funds in Q1 2024. This demonstrates ongoing confidence in the region’s potential for innovation and growth, despite broader market challenges. However, VCs need a differentiated strategy to succeed in fundraising. At Bridge, we stand out through our approach of founders investing in founders, a rigorous data-driven methodology, and a unique liquidity strategy.

VC Fundraising in Latin America, 2017-Q1 2024

Looking Ahead: Despite the fluctuations and challenges in the market, the future of Venture Capital in Latin America appears promising. The clear inevitability of the innovation economy, coupled with resilient high-quality companies like Pismo, which was acquired by Visa, and successful exits such as the non-tech IPO of Tiendas3B, bodes well for continued growth and development. Bridge remains bullish on the Latin American startup tech ecosystem, believing in its potential to drive transformative change and deliver substantial returns for investors.

All the data was sourced from LAVCA.