By Luis Enriquez

The history of hedge funds changed forever in the 1980s when Renaissance Technologies pioneered the Quantum Hedge Fund strategy. Since then, it has been only a matter of time before algorithms, data, and AI begin to replace humans in investment decision-making, starting with industries with vast amounts of data like hedge funds and extending to venture capital, even in emerging markets. So, what strategies are VC funds employing in Latin America in response to this trend, and how close are we to the singularity where humans are no longer deemed competent to make these investment decisions?

I understand this topic is controversial, and many readers may believe that Venture Capital is inherently about human judgment and relationships, making it resistant to automation. However, if you’re curious about this space, please bear with me for the next five minutes.

To understand how to make algorithms and use data to empower Venture Capital decisions and be more efficient first we have to look at our process deal flow process:

We must consider that when a startup enters our deal flow, it’s because it falls within an investable universe defined by our investment thesis. For instance, Bridge’s investment thesis focuses on investing in Latin America at the pre-seed and seed stages, regardless of industry. Additionally, a crucial criterion for considering a company for VC backing is that it has been invested in by what we term a respectable VC: a fund with at least $10 million USD, not a family office or a group of angels, and with a track record of more than 10 investments.

There are 4 possible outcomes in the process that we want to pay special attention to:

A.- Companies within our investable universe that we haven’t contacted but subsequently receive investments from a respectable VC. We aim to minimize the number of companies falling into this category.

Most Latam venture capital funds lack statistics on this variable. However, Canary, Caravela from Brazil, and Bridge Latam provide quarterly reports, consistently reporting contact with over 95% of companies within our investable universe that ultimately secure funding from a respectable VC.

The most common practice to perform good in this variable are

1.- Using tools like LinkedIn Sales Navigator or Harmonic to find entrepreneurs before our peers

2.- Quarterly review of how many startups go into this category and iterate with new processes to minimize this.

B.- Companies we didn’t contact and subsequently pass on, only for them to successfully raise funds from other LPs. We also aim to minimize the occurrence of startups falling into this category. Ideally, we aim to have a 30-minute call with companies that later receive funding from a respectable VC and were within our universe.

In this variable most of Latam VCs fit into two buckets: First, firms developed some tools, like a formulary that entrepreneurs fill or have some kind of point system when analyzing a company; the second category it’s more relationship driven if the founders is well known or comes recommended the firms will have a call.

C.- These are the firm’s portfolio Companies.

D.- Companies with which we’ve had a call, decided not to invest, but subsequently raise a round. This category is of paramount importance, as it represents the most inefficient process within the firm. It’s where managers and the team spend the most time and where the potential for improvement is highest.

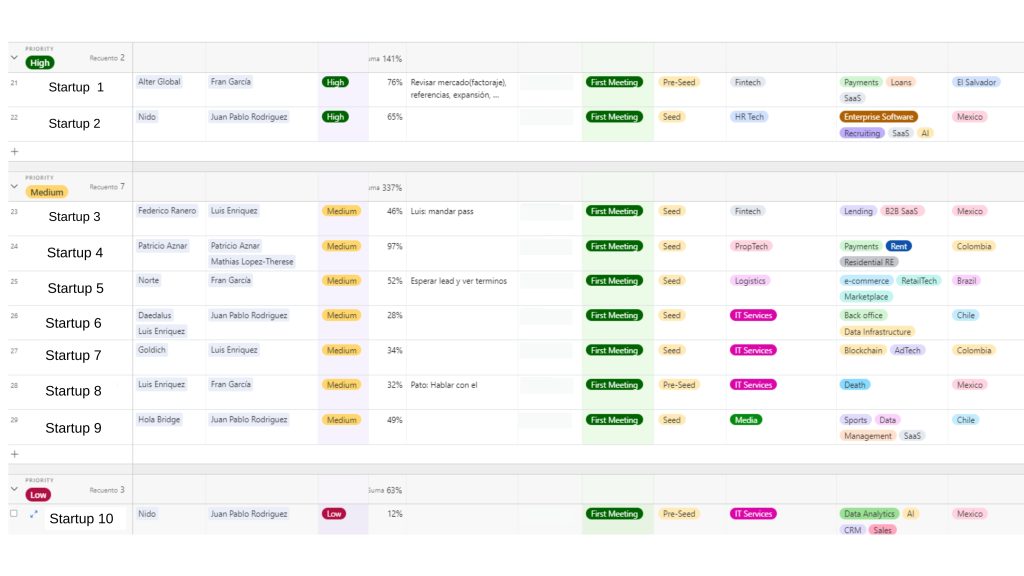

At Bridge, we’ve developed a scoring algorithm based on various variables to classify the importance of a company, including the time we allocate to evaluate it. This aids in streamlining our decision-making process and maximizing efficiency.

This scoring system is currently in its minimum viable product (MVP) phase, where we’re utilizing data from a database of 3000 companies and only employing 12 variables. However, we’re actively enhancing this model by incorporating more external variables, some of which we’re obtaining using Chat GPT, to enhance precision. Combining this information with market multiples and other factors could potentially enable us to predict returns more accurately.

In the context of the global landscape and particularly in Latin America, it’s premature for this technology to significantly alter the operations of a venture capital firm. Currently, we don’t base our decisions solely on algorithms; rather, they serve as one component in our decision-making process. Nonetheless, they already contribute to minimizing certain biases and optimizing our time.

It’s inevitable that AI, data, and algorithms will eventually replace traditional managerial roles in the venture capital industry, including partners and associates. The question remains whether this transformation will occur in 5, 10, or 40 years. At Bridge, we’re not simply waiting for this change to happen; instead, we’re actively working towards shaping that future world.