By Fran Garcia

Unlike the public markets, where stock volatility and beta can offer insights into risk, the world of venture capital has had to grapple with a less transparent landscape. However, as the markets shift and the predictable up-and-right trajectory is no longer a given, understanding portfolio correlation is taking center stage in risk management for VCs.

Drawing inspiration from Chamath Palihapitiya’s thought-provoking post last year on portfolio overlap in the VC ecosystem, Bridge Latam has embarked on a journey to shed light on investment correlation in Latin America. Chamath emphasized the absence of a meaningful analog to beta in venture capital due to the private nature of the market. Instead, he pointed towards portfolio correlation as a significant facet of risk management and a potential parallel to public market beta.

For those new to this concept, portfolio correlation in venture capital refers to how often VC funds invest in the same companies or funding rounds. A higher correlation may indicate a ‘herd mentality’—a tendency to follow the crowd, which can amplify risks during market downturns. Conversely, a lower correlation might suggest a more independent strategy that could protect against broader market fluctuations.

Taking this concept to heart, Bridge Latam conducted an analysis of investment overlaps among several VC firms within the Latin American sphere. We selected some VC funds in Latin America with no particular criteria. Our methodology included combing Crunchbase and the websites of those VC funds to map out our peer group’s portfolio overlaps. It’s important to note that while we strived for accuracy, the data is not infallible due to the reliance on publicly available information.

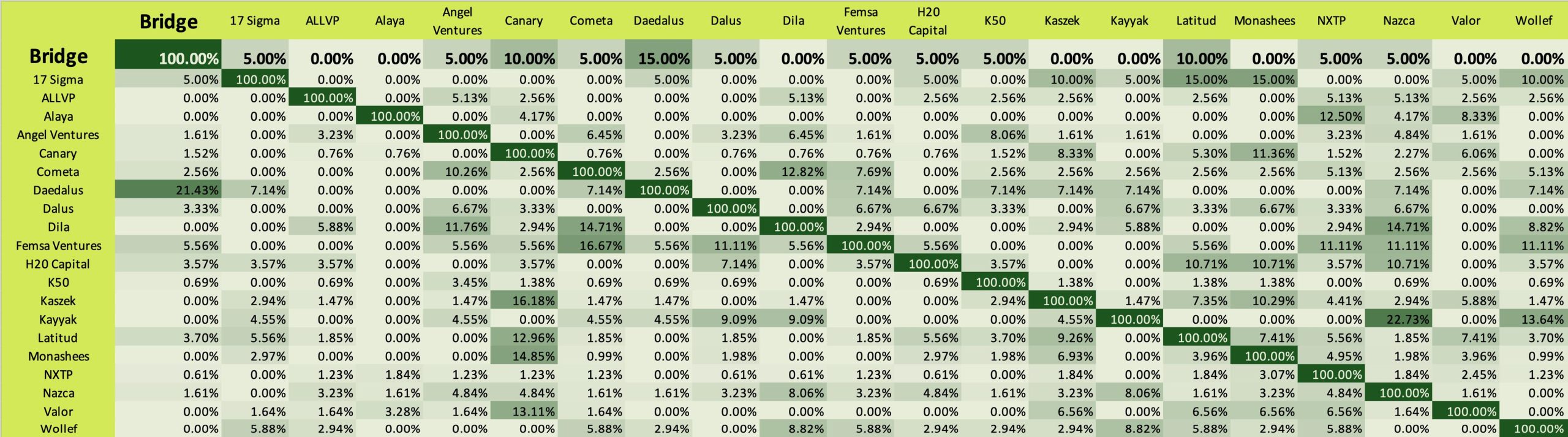

Portfolio Overlap Among Selected Latin American Venture Funds

Our findings are encapsulated in a correlation matrix, which provides a visual representation of how these investment strategies intersect. To navigate this matrix, let’s take a practical example: Bridge shows a 5% overlap with Nazca. This figure represents one co-investment in Auba. For Bridge, this is one out of 20 investments, translating to 5%. Conversely, from Nazca’s perspective, with 62 publicly available investments, the single co-investment with Bridge equates to approximately 1.6%.

Interestingly, our preliminary insights suggest that Latam VC funds exhibit a relatively low correlation with one another. This is a critical factor for LPs to consider. Investing in multiple funds with high overlap doesn’t necessarily equate to diversification. In fact, it may increase exposure to market volatility, as similarly structured portfolios can be affected by the same market forces.

In conclusion, and in the spirit of informed decision-making, Bridge Latam encourages everyone to draw their own conclusions. The correlation matrix is not just a snapshot of current trends; it’s a conversation starter on investment strategies and risk in the Latin American market.