By Fran García

After an amazing and eye-opening trip to Sao Paulo, I got to compare the tech scenes in Mexico and Brazil, and noticed some very interesting differences.

Let me give you some context. I started investing in early-stage startups in 2020, but I hadn’t looked into Brazilian startups until I joined Bridge six months ago. Over the last half-year, I’ve been studying and connecting with the Brazilian Venture Capital scene. At Bridge, we’ve supported three incredible entrepreneurs: Brunno Novarini from Quaddro, Marco Perlman (Aravita), and Fernando Brustolini (Dinerama). Lately, I’ve been chatting with many founders working in Brazil and I’ve learnt a lot about the ecosystem over there.

To have a more clear understanding about the market and to connect in-person with a group of amazing people that I’ve previously met virtually, I went to Sao Paulo for a couple of weeks. I went to the Vamos Latam Summit organized by Latitud (the biggest tech event in Latin America). Days before the event, Bridge hosted a Happy Hour with great VCs who we have coinvested with: Norte Capital, Alexia Ventures and Caravela Capital. And for those days, I had the opportunity to meet almost every VC fund in Sao Paulo.

Before I get into Pix, I want to mention a couple of surprising things I noticed about this amazing country. First, in Brazil, debit and credit cards come on the same piece of plastic. You don’t need two separate cards like in Mexico or the US. To be honest, it’s more practical. When I talked to Brazilians about having two cards in Mexico (one for debit and one for credit), they were just as surprised as I was. Second, almost everywhere you go in Brazil, they ask for your CPF (the individual taxpayer ID), which is like the RFC in Mexico.

Let’s talk about Pix

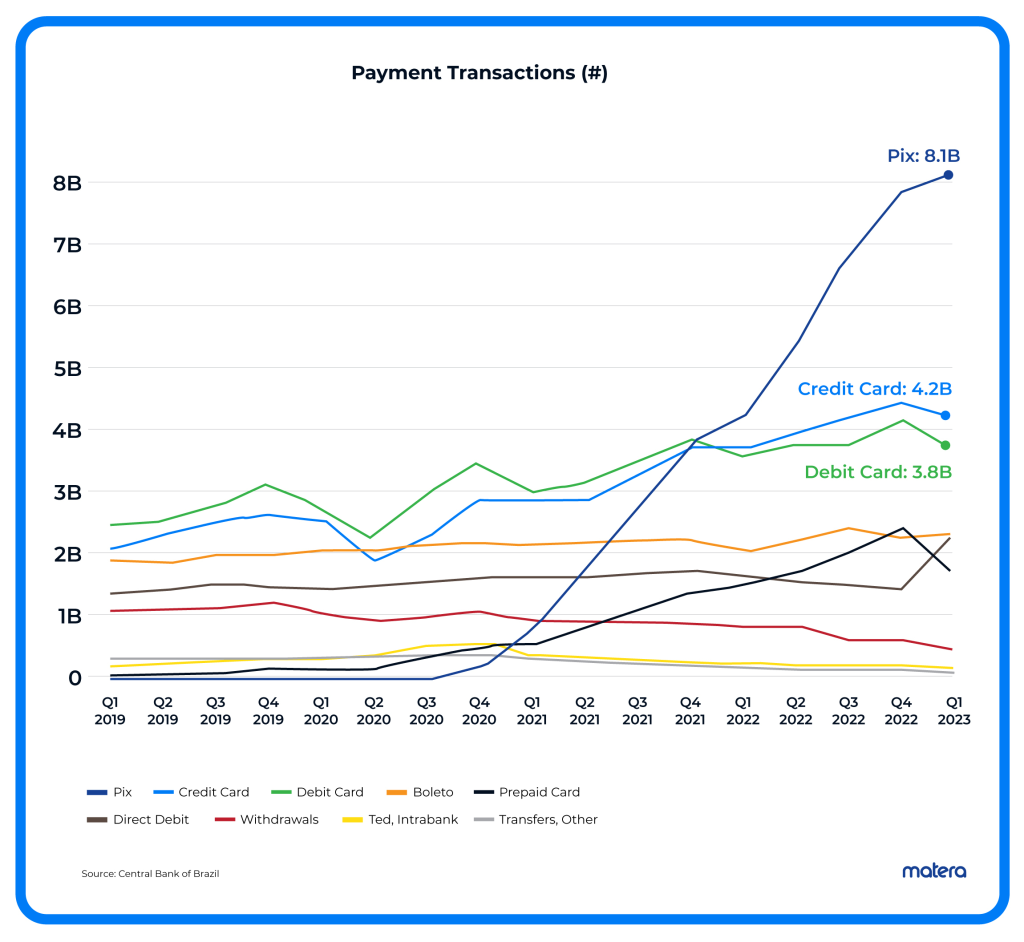

Now, shifting focus to Pix, I believe practically everyone in the tech world in Mexico has heard great things about it. For those who don’t know, Pix is a payment system created by the Brazilian Central Bank to enable instant payments. Before Pix came into the scene in November 2020, making money transfers within banks in Brazil was slow and not very efficient. Pix has now become the go-to payment method in Brazil, beating out credit and debit cards (meaning fewer fees for banks!).

Below a list of Pix quarterly transactions:

Just before my trip to Brazil, I quickly exchanged some Mexican pesos for Brazilian reals at the airport. But when I tried to use cash, I noticed people giving me strange looks. Using cash isn’t that common in Brazil, at least based on my experience in Sao Paulo—I might be making a generalization.

I had a lot of conversations about Pix and got to see firsthand how it’s used. The experience is so simple, and it’s integrated into every bank app in Brazil. People can transfer money to anyone with Pix using just an email address, cell phone number, CPF (individual taxpayer ID in Brazil), or a randomly assigned key. This simplicity is crucial for people to easily send money using Pix. To have Pix, you HAVE to have a bank account, and this is where things get interesting.

Note that almost every street vendor accepts PIX:

Why PIX worked and got an amazing adoption in Brazil?

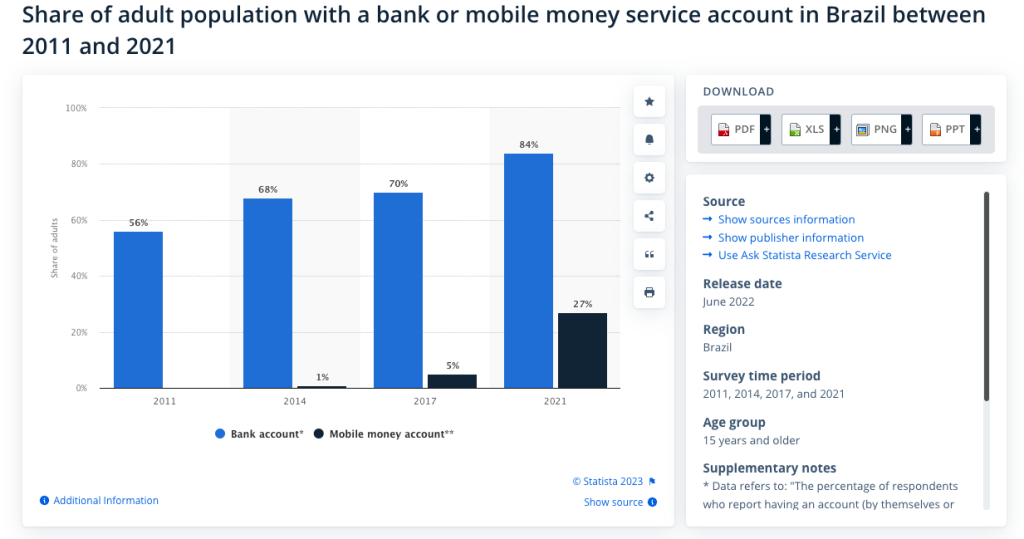

The main reason was that most people already had bank accounts. Around early 2021, when PIX was starting, a whopping 84% of the population had a bank account. So, it made sense for everyone to switch to a simpler and faster money transfer method compared to other options. The user interface was really straightforward—you just needed an email, phone number, CPF, or key to make a transfer. Many other things played a part, but the big one was that most Brazilians already had a bank account, well over 84% of them.

Throughout the pandemic, Brazil shifted millions of people towards digital platforms and banking. The government organized this movement to facilitate the distribution of transfers and aid during the COVID emergency, with Caixa Econômica taking the lead.

Another thing that helped PIX catch on was that bank transfers, before PIX came along, were slow and not a great experience.

Why PIX would not work in Mexico?

In Mexico, there was an attempt to create something similar. CoDi, short for “Cobro Digital,” was an initiative by the Central Bank aimed at simplifying payments. However, CoDi didn’t come close to achieving the success of Pix. Since its launch in 2019, CoDi has only recorded 9 million transactions. To put it in perspective with Pix, in May 2023 alone, PIX saw a whopping 2.7 billion transactions. Pix turned out to be a triumph, whereas CoDi proved to be unsuccessful.

Why CoDi did not work out?

Two main reasons explain why CoDi didn’t get as popular as the Mexican Central Bank hoped.

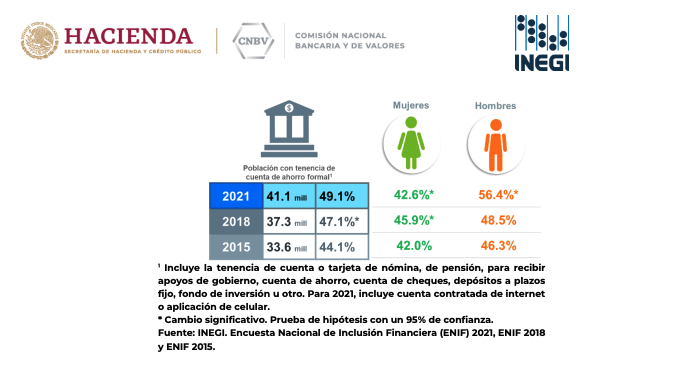

Firstly, when CoDi started in 2019, less than 50% of the population in Mexico had a bank account. Unlike Brazil, during the pandemic, the number of new bank accounts didn’t increase. There weren’t many reasons for those without a bank account to open one.

Secondly, when CoDi was introduced in Mexico, the issue of slow bank transfers wasn’t as significant as it was in Brazil during the launch of PIX. Mexico already had SPEI, which made bank transfers faster, starting from 2004. Although not perfect, it improved the bank transfer problem. So, Mexico had a version of PIX long before CoDi arrived. There wasn’t much struggle, so people continued using SPEI for bank transfers, and CoDi wasn’t necessary.

What’s next for Mexico?

Mexico’s Central Bank has just introduced DiMo, short for “Dinero Móvil,” as another attempt to facilitate money transfers between bank accounts. They’ve taken a page from PIX by incorporating the use of cell phone numbers for transactions.

Based on my observations in Brazil and conversations with PIX users, the user experience with PIX is incredibly smooth, fast, and simple. People simply log into their banking apps and seamlessly utilize PIX within them. DiMo will need to offer an excellent user interface and experience to gain widespread adoption.

What I see as a barrier for DiMo to succeed is the low bank account penetration that Mexico currently has. If I were to bet on whether it will work, I don’t think it will. The problem that needs to be addressed first is bank account penetration in Mexico and to create incentives for people who do not have a bank account.

You’ve got to start with the customer experience and work back toward the technology, not the other way around.” – Steve Jobs