Since its first investment in 2022, Bridge has diligently analyzed over 1,100 startups operating in the region. Through their extensive research, Bridge has observed a notable trend in the round sizes and valuations of these startups. As an investor primarily focused on Pre Seed and Seed stages, the fund’s findings shed light on the evolving landscape of startup financing in Latin America.

It is essential to note that the sample analyzed by Bridge consists of companies that have either raised or attempted to raise an early-stage round, encompassing various funding stages such as Seed, Pre Seed, Pre Series A, and Venture Rounds. Given Bridge’s emphasis on Pre Seed and Seed, the dataset leans towards companies in these early stages of development. The findings may not capture the entire spectrum of startups in the region, and individual cases may deviate from the average.

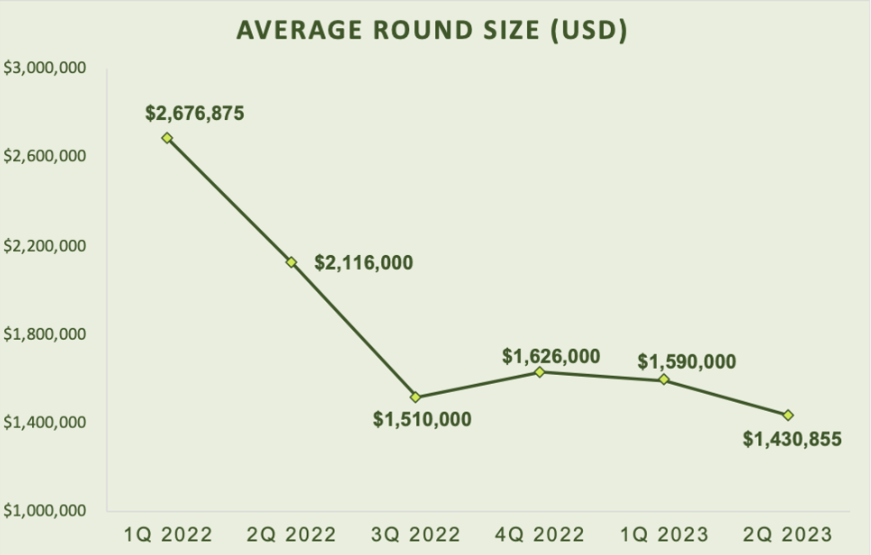

Over the period from 1Q 2022 to 2Q 2023, Bridge has observed a significant contraction in the average round size. In 1Q 2022, the average round size stood at USD $2.6 million, while by 2Q 2023, it had decreased to USD $1.4 million. This reduction in round size indicates a shifting landscape where startups are seeking smaller funding amounts to support their growth and operations.

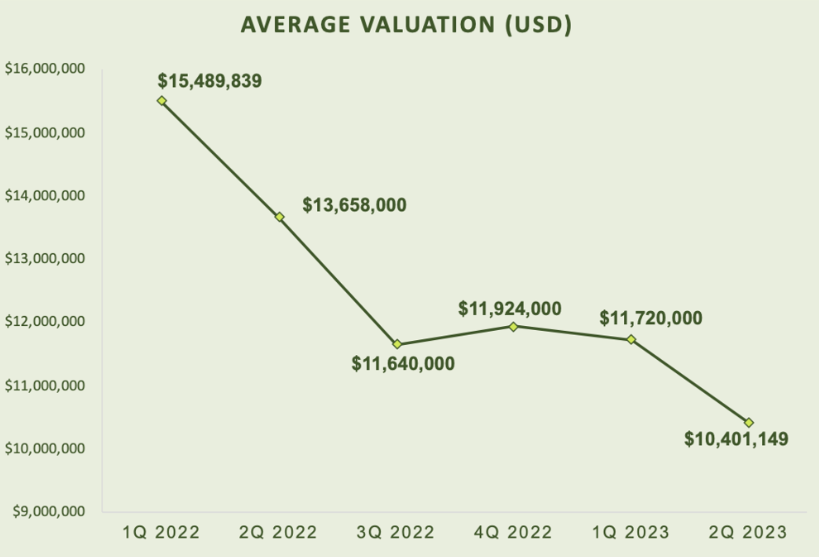

Similarly, the average valuation of startups in Latin America has experienced a decline during the same period. In 1Q 2022, the average valuation reached USD $15.5 million, but by 2Q 2023, it had dropped to USD $10.4 million. It is crucial to remember that these figures represent an average and should be interpreted with caution.

Several factors contribute to this downward trend in round sizes and valuations among Latin American startups. Firstly, the rise in interest rates plays a significant role. As interest rates increase, investors become more cautious and scrutinize potential investments more closely. This caution can lead to reduced funding amounts and lower valuations as startups face greater scrutiny when seeking financing.

Additionally, the macroeconomic environment and the impact on public tech companies valuation multiples have affected the startup ecosystem in Latin America. When public tech companies experience a decrease in their valuation multiples, investors may reassess their risk appetite and adjust their expectations for startups accordingly. Lower valuations among public companies can influence the valuations assigned to startups, causing a ripple effect throughout the investment landscape.

Furthermore, the excess liquidity that characterized the investment landscape in 2021 has also played a role in shaping the current funding environment. With an abundance of available capital, investors may have been more willing to provide larger funding amounts and assign higher valuations to startups. However, as the market adjusts and liquidity normalizes, the funding landscape has adapted, leading to smaller round sizes and lower valuations.

While the decrease in round sizes and valuations may appear concerning on the surface, it is essential to view these trends in the context of a maturing startup ecosystem. As the Latin American startup ecosystem continues to evolve, investors and startups alike are navigating a path towards sustainable growth and long-term success. The adjustments in round sizes and valuations can be seen as a healthy recalibration, ensuring that startups receive the appropriate funding they need to thrive while maintaining realistic valuations.

In conclusion, Bridge’s analysis of over 1,100 startups in Latin America reveals a downward trend in round sizes and valuations. Factors such as rising interest rates, the macro environment, public tech companies’ valuation multiples, and the normalization of excess liquidity have influenced this shift. Looking ahead, the future of the Latin American startup ecosystem holds great potential. As the region continues to mature and develop, we can expect to see further adjustments and refinements in funding dynamics.